Annual Report 2024

2024 saw the ECB advance further through its monetary policy cycle. This cycle has consisted of three distinct phases. The first was a tightening phase, which ran from July 2022 to September 2023, during which interest rates rose by a record 450 basis points. The second was a holding phase in which rates remained steady. And in the third – a dialling-back phase which began in June 2024 – monetary policy has gradually become less restrictive.

The period under review in this report falls into the last two phases of this policy cycle. At the start of 2024 the ECB was still in the holding phase, with its deposit facility rate at 4%. At that time, inflation had fallen around three-quarters of the way from its peak, and stood at 2.9%. The staff projections were showing inflation returning to our medium-term target of 2% in 2025. But there was uncertainty about the persistence of inflation.

Measures of domestic inflation were high and sticky. Past increases in inflation were still passing through to wages in a staggered way. And the staff projections hinged on firms absorbing these wage increases through profits, rather than raising prices, and on a recovery in labour productivity that would lower unit labour costs. Both of these factors could only be confirmed over time.

To deliver robust policy in this context, the ECB had – since March 2023 – been basing its rate decisions on three key criteria: the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission. While the inflation outlook was improving and monetary policy was clearly dampening demand, the underlying inflation criterion called for caution.

Over the course of 2024, however, our restrictive policy stance ensured that inflation continued to fall towards our target. By June, not only had the inflation outlook remained stable, indicating consistently that inflation would reach 2% in 2025, but also most measures of underlying inflation had eased. This “cross-check” bolstered the ECB’s confidence that inflation was returning to its target in a sustained manner.

Consequently, after nine months of holding rates steady, we began dialling back the level of monetary policy restriction. In June we cut rates by 25 basis points, while remaining data-dependent and not pre-committing to a future path for rates. As the incoming data confirmed the favourable inflation outlook, we gradually reduced the degree of monetary policy restriction further.

Over the course of September, October and December, we reduced our main policy rate by a further 75 basis points. We ended the year increasingly confident that the disinflation process was well on track.

Our balance sheet also continued to normalise during 2024, declining by half a trillion euro. At the end of December, two milestones were reached: the full repayment of funds borrowed by banks under the third series of targeted longer-term refinancing operations, and the end of reinvestments of the principal payments from maturing securities purchased under the pandemic emergency purchase programme.

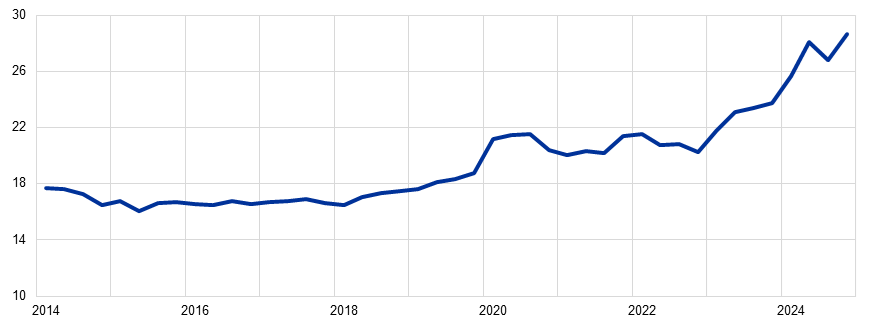

In an environment of gradually declining liquidity owing to the normalisation of the balance sheet, the ECB introduced changes to its operational framework for implementing monetary policy. In particular, the ECB announced it would continue to steer the monetary policy stance by adjusting the deposit facility rate, while also narrowing the differential between it and the rate on the main refinancing operations. Going forward, the ECB will provide liquidity to the financial system through a broad mix of instruments. And on the basis of the experience gained, the Governing Council will review the key parameters of the operational framework in 2026.

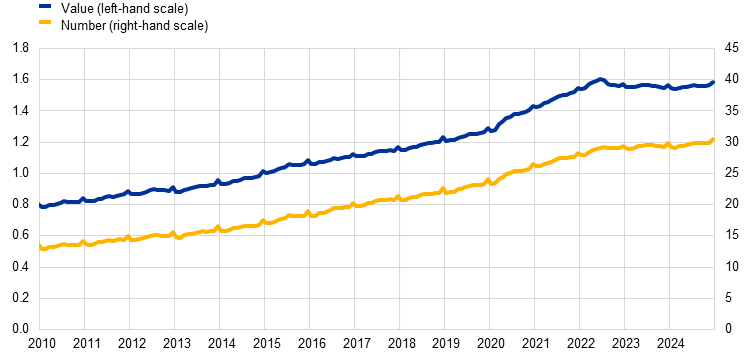

It was an eventful year for payments as well. Driven by the rising number of participants in the TARGET Instant Payment Settlement (TIPS) system – a service developed by the Eurosystem to enable instant payments across Europe – the daily average number of instant payments in euro surged by 72% over the year.

In 2024 the Eurosystem moved onward with its two-year preparation phase for a digital euro. The first digital euro progress report was published in June, and the second in December. The ECB also continued its work on developing a digital euro scheme rulebook, which will standardise the digital euro’s use and management in the euro area. Preparations for the development of a new series of euro banknotes also gathered pace. The Governing Council has now selected motifs for the themes “European culture” and “Rivers and birds” and established a jury for a design contest to be launched later in 2025.

As the world becomes more digital, the ECB is taking decisive steps to integrate artificial intelligence technologies into its work. ECB staff can now use four large language models to support their work, benefiting over 4,500 users, and there are several experimental projects ongoing in areas including automated communication and data visualisation.

In 2024 the ECB also expanded its work on climate change with the launch of its climate and nature plan 2024-2025. This initiative focuses on three key areas: the impact and risks of the transition to a green economy; the increasing physical impact of climate change and the economic effects of climate change adaptation; and the risks of nature loss and degradation and their interaction with climate-related risks.

In 2024 the House of the Euro – located in Brussels and bringing together the ECB and seven national central banks – celebrated its first year. Established to foster cooperation among Eurosystem central banks and enhance their visibility in a city where many European institutions are based, the House of the Euro has become a dynamic hub for collaboration, dialogue and debate between central bankers and key stakeholders.

In an increasingly uncertain world, more Europeans are recognising the importance of unity. And in 2024 support for the euro among citizens reached a record high, reflecting a broader appreciation for the single currency as a project that fosters European peace and prosperity. This growing support also underscores the dedication of the ECB’s staff and others working to serve the interests of the people of Europe.

Frankfurt am Main, April 2025

Christine Lagarde

President

|

|

The economy started to recover |

Headline inflation declined towards the target |

Euro area real GDP grew by 0.9% in 2024, compared with 0.4% in 2023. Quarterly growth rates turned positive at the start of 2024 after five consecutive quarters of stagnation. |

Headline inflation declined to 2.4% in December 2024 from 2.9% in December 2023, moving closer to the target. |

|

|

The ECB lowered the three key ECB interest rates, bringing the deposit facility rate to 3.00% by the end of the year |

The Eurosystem continued to reduce its balance sheet |

The reduction in the key ECB rates brought the deposit facility rate to 3.00% and its cumulative decrease over 2024 to 100 basis points. |

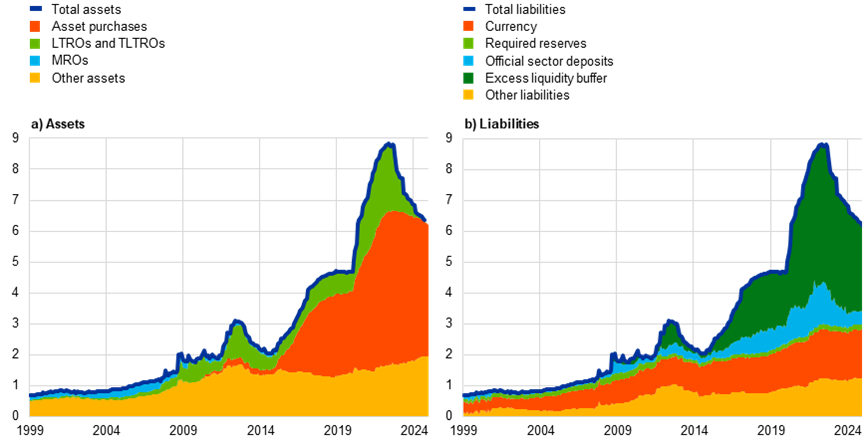

The Eurosystem’s balance sheet declined by €0.5 trillion, reflecting the end of the third series of targeted longer-term refinancing operations (TLTRO III), the decline in the asset purchase programme (APP) portfolio and, to some extent, the shift to partial reinvestments under the pandemic emergency purchase programme (PEPP). These measures had played a key role during the low inflation era and the pandemic. |

|

|

Euro area bank resilience |

Instant payments settled by TIPS increased |

The Common Equity Tier 1 ratio of euro area banks remained close to its historical high, standing at 15.7% in the third quarter of 2024. This reflected strong bank profitability and a low level of non-performing loans. |

With a growing number of participants in TARGET Instant Payment Settlement (TIPS), instant payments in euro increased from 963,894 per day in December 2023 to 1,657,421 in December 2024, a rise of 72%. |

|

|

The ECB’s Visitor Centre |

Climate-related financial disclosures for the Eurosystem’s monetary policy holdings |

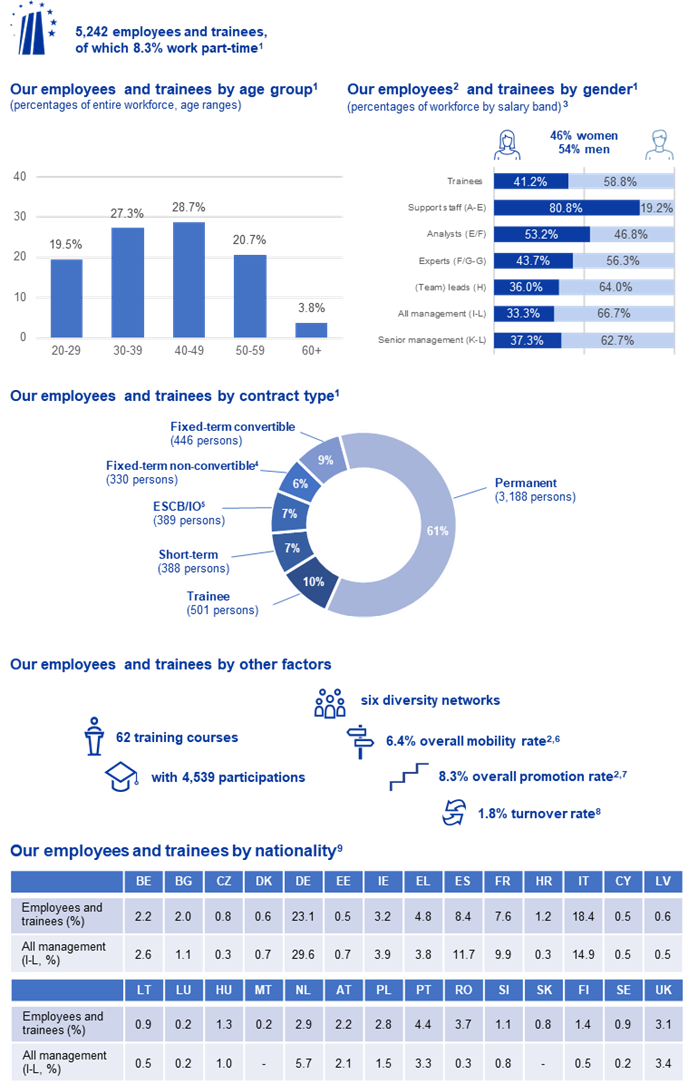

A total of 21,325 visitors were hosted by the ECB’s Visitor Centre in 2024, giving the public the opportunity to get to know the ECB from the inside. |

The ECB enhanced transparency about the Eurosystem’s carbon footprint by expanding the climate-related financial disclosures to cover over 99% of the assets held for monetary policy purposes. |

Global economic activity remained resilient in 2024, continuing to expand at a moderate pace. Uncertainty increased during the year to elevated levels, amid heightened geopolitical tensions and questions surrounding economic policies, particularly following the US presidential elections. Global trade recovered from its slowdown in 2023 as imports were frontloaded in the face of geopolitical and trade policy uncertainty. Global inflation moderated further, although persistent services inflation across advanced economies slowed the disinflation process. The euro depreciated against the US dollar and to a lesser extent also in nominal effective terms. The euro area economy strengthened in 2024, largely on the back of positive global growth momentum and a resilient services sector, in the context of falling overall inflation. At the same time, industry remained weak, affected by restrictive financing conditions, high energy and other input costs, structural shortcomings and elevated uncertainty. While the ECB’s monetary policy tightening of the previous years continued to be transmitted forcefully to economic activity, underpinning the sustained decline in inflation over 2024, the labour market remained fairly resilient. Euro area governments continued to wind down support measures adopted in response to the COVID-19 pandemic, energy price and inflation shocks, reversing part of the previous fiscal loosening. Headline inflation in the euro area fell further in 2024, but more slowly than in the previous year as the impetus from unwinding energy inflation had dissipated. Underlying inflationary pressures moderated as a result of the fading impact of past supply shocks and the weaker demand associated with tight monetary and financing conditions and fiscal policies, but also remained under the influence of strong wage growth.

1.1 Global economic activity was resilient while headline inflation declined further

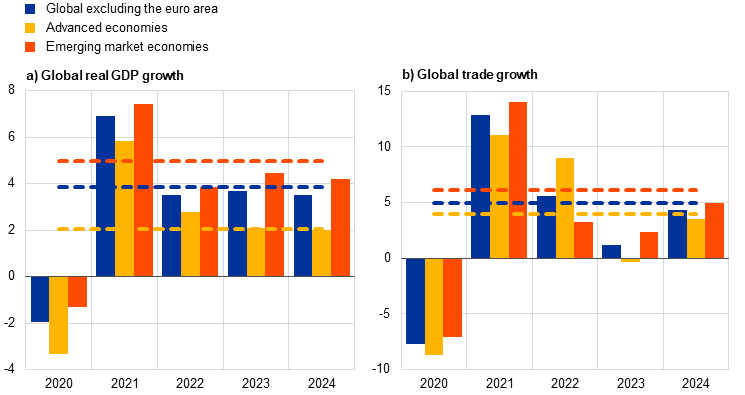

Global economic growth remained resilient in 2024 despite headwinds

The global economy remained resilient in 2024 but risks to growth remained tilted to the downside amid widening divergences across sectors and countries. Economic activity expanded at a steady yet moderate pace of 3.4%, almost unchanged from the previous year but below its historical average (Chart 1.1, panel a). Activity was uneven across country groups, with emerging markets economies expanding by 4.1% while advanced economies grew at the slower pace of 1.9% (Chart 1.1, panel a). The disparities in growth rates were consistent with historical patterns, the long-run average growth in emerging markets over the period 1999-2023 exceeding that of advanced economies by 3.1 percentage points. Developments in global economic activity were also uneven across sectors, with global growth supported in particular by a robust services sector, contrasting with weaker activity in manufacturing. Global uncertainty remained elevated and near-term headwinds to growth increased during the year, reflecting heightened geopolitical tensions and economic policy uncertainty, especially on the trade and fiscal fronts following in particular the US presidential elections.

Economic growth remained robust in the United States but slowed in China

In the United States, economic activity remained robust throughout 2024, mostly reflecting solid domestic demand, in particular household spending. The tight US labour market eased over 2024, with the unemployment rate rising to 4.1% at the end of the year from 3.7% at the start. In China, economic growth slowed in 2024, albeit marginally. Muted domestic demand amid subdued consumer confidence and the protracted weakness in the real estate sector continued to weigh on growth, but improving net exports and fiscal and monetary stimulus supported growth momentum towards year-end.

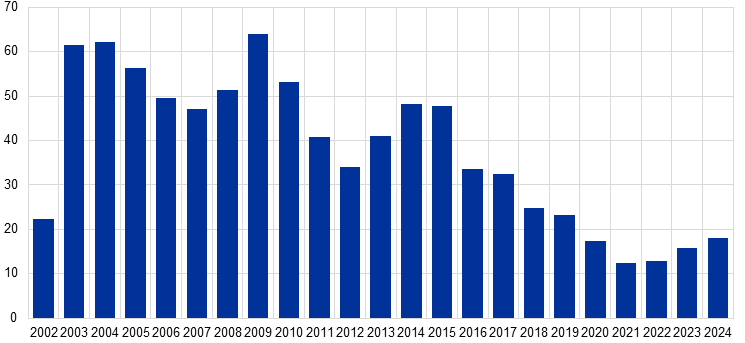

Chart 1.1

Global activity and trade developments (excluding the euro area)

(annual percentage changes)

Sources: Haver Analytics, national sources and ECB calculations.

Notes: Panel a): “global GDP” excludes the euro area. The aggregates are computed using GDP adjusted with purchasing power parity weights. Panel b): global trade growth is defined as growth in global imports including imports to the euro area. In both panels the dashed lines indicate the long-term averages between 1999 and 2023, and the latest observations are for 2024 as updated on 28 March 2025.

Global trade picked up in 2024 as imports were frontloaded amid higher uncertainty

Global trade recovered significantly in 2024, with import growth increasing to 4.4% from 1.2% in the previous year, although remaining slightly below its long-term average (Chart 1.1, panel b). Global trade growth was supported by strong demand for imported goods being brought forward amid concerns about disruptions to shipping routes in the Red Sea and possible delays ahead of the end-of-year holiday season. In the United States imports were also frontloaded given uncertainties associated with port strikes on the East Coast and with trade policies. A normalisation of goods imports, compounded by a still weak manufacturing cycle and a less favourable composition of global demand, were expected to have led to slowing trade momentum towards year-end.

Global inflation moderated further in 2024, but services price pressures remained persistent

Global annual headline consumer price index (CPI) inflation continued to ease in 2024 (Chart 1.2). It stood at 3.0% in October 2024, compared with 3.4% at end-2023. The decline in headline inflation was led by food and energy inflation, as well as core goods inflation (i.e. excluding food and energy). Services price pressures remained persistent across advanced economies.

Chart 1.2

Global headline inflation and its main components

(annual percentage changes; monthly data)

Sources: National sources and OECD via Haver Analytics, and ECB staff calculations.

Notes: Global inflation (excluding the euro area) is computed on the basis of national CPIs and annual GDP weights expressed in purchasing power parity (PPP) terms. The aggregate is calculated on the basis of 22 countries covering 74% of global GDP (excluding the euro area) in PPP. The contributions of components to headline inflation are computed using average weights for OECD countries. Core goods inflation and core services inflation exclude energy and food.

The latest observations are for December 2024.

The major risks to the outlook for global economic growth at the end of 2024 included increased global economic fragmentation and trade protectionism, notably in the United States, an escalation of geopolitical tensions in the Middle East or in Russia’s war against Ukraine, more frequent and severe weather events, and a further slowdown in China.

Energy commodity price fluctuations were driven by geopolitical developments

In terms of year-end values, energy prices rose overall in 2024 compared with 2023, as an increase in European gas prices offset a decline in oil prices. Brent oil prices dropped by 5%, primarily driven by demand-side factors, including subdued manufacturing output in Europe and a slowdown in Chinese economic activity. On the supply side, conflict in the Middle East and prolonged production cuts by OPEC+ countries kept oil prices from falling further but proved insufficient to drive them higher. European gas prices increased by 52% in terms of year-end values, although remaining well below their 2022 peak. Gas prices initially fell as a result of persistently low European consumption, particularly in the industrial sector. From the second quarter onward, however, prices rose steadily on supply-side pressures, including unplanned outages in Norwegian gas supplies, episodes of escalation in Russia’s war against Ukraine, and concerns surrounding the expiry of the gas transit agreement between Russia and Ukraine. By year-end, European gas storage levels had fallen below those of 2022 and 2023 and were also below their pre-energy crisis year-end average, highlighting Europe’s challenges in maintaining a sufficient precautionary buffer over the long term.

The euro depreciated against the US dollar in 2024, and to a lesser extent in nominal effective terms

Following intra-year fluctuations, the euro ended 2024 somewhat lower in nominal effective terms (-1.1%) than at the end of 2023, as a result of partly offsetting bilateral exchange rate developments. On the one hand, the euro depreciated against the US dollar (-6.0%), a movement which was supported by positive US economic data surprises, flight-to-safety flows amid global geopolitical tensions and, later in the year, expected policy shifts under the new US Administration. Then as also euro area economic data weakened in the fourth quarter of 2024, interest rate markets anticipated a steeper path of future policy rate cuts in the euro area and a shallower path in the United States, which further weighed on the euro against the US dollar. Similarly, expectations of persistently restrictive monetary policy in the United Kingdom strengthened the pound sterling, both broadly and relative to the euro. The euro also weakened against the Chinese renminbi in 2024, albeit to a lesser extent (‑3.4%) as the renminbi’s strength was lessened by mounting economic headwinds in China. On the other hand, the euro strengthened against the currencies of most of its other major trading partners. Among them, the Japanese yen was under downward pressure through most of 2024, as persistently low interest rates in Japan reportedly fuelled “carry trade” flows from the yen into higher-yielding currencies.

1.2 Economic activity began to recover gradually in the euro area

Euro area economic activity started to recover amid ongoing headwinds

Euro area real GDP grew by 0.9% in 2024, compared with 0.4% in 2023 (Chart 1.3). Quarterly growth rates turned positive at the start of 2024, after five consecutive quarters of stagnation, before slowing down again at the end of the year. The strengthening in growth was attributable mainly to the services sector, which continued to benefit from post-pandemic structural changes including a faster shift towards a more knowledge-based economy, the green transition and changing consumer spending patterns. Recovering real incomes, global trade and the Next Generation EU (NGEU) programme also supported economic growth. At the same time, the industrial sector remained weak owing to a combination of both structural and cyclical factors. The industrial sector was more affected than services by the still restrictive conditions from the past monetary policy tightening cycle and high input costs. While most models show that the peak impact of the tightening on economic activity was reached in the period at the end of 2023 and the beginning of 2024, the monetary policy loosening cycle which started in mid-2024 had not yet fed through the economy. The industrial sector was also affected by the euro area losing export market share, as well as by regulatory challenges and by elevated uncertainty relating to both political and geopolitical events. Overall, growth in 2024 reflected positive contributions from private and public consumption as well as net trade, while investment and changes in inventories dampened economic activity.

Chart 1.3

Euro area real GDP

(annual percentage changes; percentage point contributions)

Source: Eurostat.

Note: The latest observations are for 2024.

Private consumption accelerated marginally, driven by services

Private consumption accelerated in 2024, increasing by 1% compared with the previous year. Despite robust services consumption, total private consumption increased only modestly in the first half of the year, as demand for goods remained weak (Chart 1.4). It accelerated strongly in the third quarter of the year, boosted by temporary factors such as the Paris 2024 Olympic and Paralympic Games, and moderated in the fourth. The growth of real disposable income supported household spending in 2024, as nominal wage growth increased, inflation slowed and employment growth remained resilient. Nevertheless, still tight financing conditions continued to weigh on household spending, with savings remaining elevated overall.

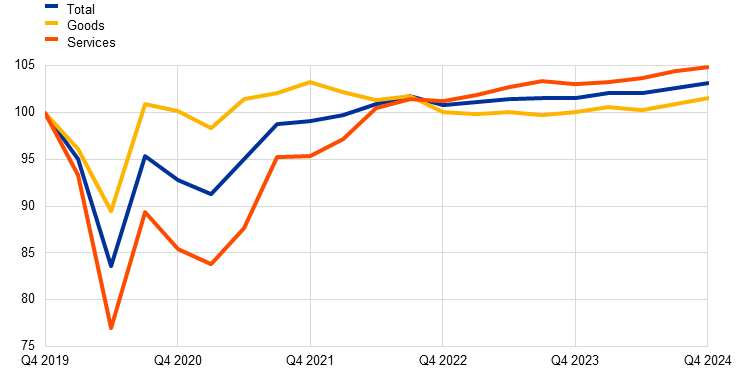

Chart 1.4

Euro area consumption, non-construction investment and housing investment

(indices: Q4 2019 = 100)

a) Private consumption

b) Investment

Sources: Eurostat and ECB calculations.

Notes: In panel a), private consumption refers to the national concept of consumption, and its components refer to the domestic concept of consumption. The latest observations are for the fourth quarter of 2024.

Investment was held back by tight financing conditions and high uncertainty

Housing investment fell strongly in 2024, amid still restrictive financing conditions and weak demand. It contracted by 4.0% compared with 2023, recording the largest annual decline since 2009, during the global financial crisis. This contraction was mainly due to the lagged impact of the monetary policy tightening, resulting from higher mortgage rates and tighter bank lending standards. Although real incomes were recovering and house price growth remained modest, tight financing conditions limited housing affordability and depressed demand for residential real estate property. However, given the strong post-pandemic recovery in housing investment, in part supported by (now expired) generous fiscal incentives in Italy, housing investment remained 1.3% above its pre-pandemic level at the end of 2024, although it fared worse than private consumption (3.1%) and non-construction investment (5.2% excluding Irish intangibles).

Non-construction investment (the closest national accounts proxy for business investment) contracted again in 2024, against a background of weak domestic and foreign demand, tight financing conditions and high uncertainty on various fronts. Overall, non-construction investment contracted by 2.3% compared with 2023, albeit with considerable quarterly volatility throughout the year (see Chart 1.4). Excluding volatile multinational-driven intangibles in Ireland, it declined by 0.5% in 2024.[1] The outcome reflects both a continuation of weakness in investment in machinery and equipment and a deceleration in the rates of intangible investment growth over recent years. Amid muted domestic demand and a weaker export sector, longer-term production expectations – typically a key driver of investment – remained subdued throughout the year, reducing firms’ incentives to invest. Concerns over competitiveness losses, moderating profitability, and high and wide-ranging uncertainty – stemming from geopolitical developments, increasing fears of growing trade fragmentation and heightened policy uncertainty – also weighed further on business investment in 2024.

Euro area exports remained subdued despite improving foreign demand

Euro area exports improved slightly in 2024, but remained on a relatively weak trajectory. Several elements contributed to subdued export growth, despite a backdrop of improving foreign demand. Lagged effects from the past appreciation of the euro had a negative impact. Energy costs remained a significant concern, with relatively high gas prices increasing production expenses for euro area exporters, thereby squeezing profit margins and reducing competitiveness. Weak demand from China, especially for capital goods, and increased competition from Chinese manufacturers also posed challenges for the euro area. Imports grew at a subdued rate, affected by weak domestic demand and investment. Overall, net trade had a slightly positive impact on growth. The euro area trade balance further improved in 2024 compared with 2023.

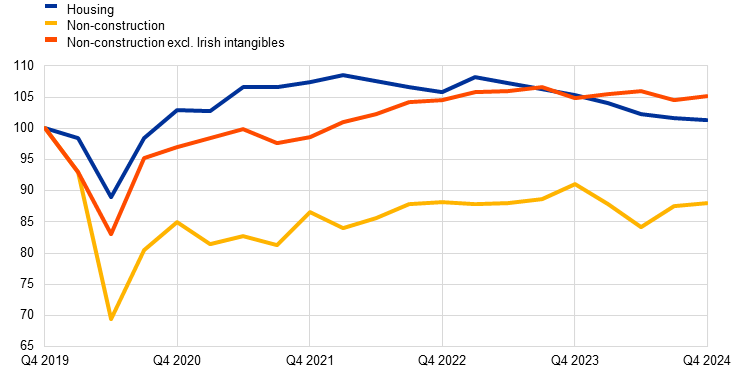

Labour market

The euro area labour market remained resilient, while labour productivity growth was flat

The euro area labour market remained resilient overall in 2024, although employment growth slowed relative to recent years and survey indicators suggested that labour markets were cooling over the course of the year. The unemployment rate declined from 6.5% in January to 6.2% in December – one of the lowest points recorded since the introduction of the euro and 1.3 percentage points below the pre-pandemic level observed in January 2020. The unemployment rate was also 6.2% on average in the last quarter of the year (Chart 1.5). Total employment and total hours worked kept broadly in line with the growth of the economy, both rising in 2024 by 1%. These developments led to a largely flat productivity path. The weak growth of labour productivity was mostly cyclical, driven by weak demand, while companies hoarded labour, i.e. held on to more workers than necessary in a period of low economic growth. However, structural factors may also have played a role. Average hours worked declined by 0.1% in 2024 and, as of the last quarter of the year, remained 0.9% below the pre-pandemic level. The path of average hours worked continued to reflect factors such as the hoarding of labour from the second half of 2023 and still elevated levels of sick leave. The labour force participation rate in the age group 15-74 years increased to a level of 66% in the fourth quarter of 2024, which is 1.2 percentage points above its pre-pandemic level. Women, older workers, persons with higher education and foreign workers have contributed the most to this increase in the labour force. Labour demand weakened in 2024 compared with previous years, with the job vacancy rate receding further from its peak in the second quarter of 2022 to a level of 2.5% in the fourth quarter of last year, still above its pre-pandemic level of 2.3% in the last quarter of 2019.[2] The catch-up of nominal wages with inflation favoured a realignment of employment and output dynamics, while bringing real wages more into line with the recovery in productivity. Therefore, by means of its medium-term orientation, and without prejudice to maintaining price stability, the monetary policy of the ECB contributed to supporting employment and productivity, which are among the European Union’s objectives to which the ECB can contribute.

Chart 1.5

Labour market

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: percentages)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for December 2024 for the unemployment rate, and for the fourth quarter of 2024 for employment, total and average hours worked and productivity per hour worked.

1.3 Euro area fiscal stance tightened

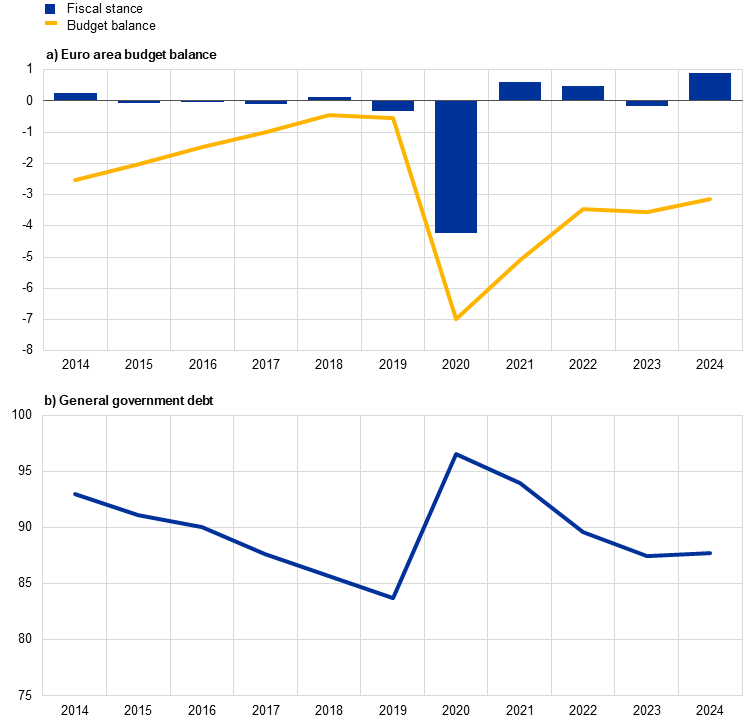

The euro area fiscal stance likely tightened, reflecting the phasing-out of public support measures that had been introduced in response to the energy crisis and high inflation

The euro area general government deficit is expected to have narrowed further in 2024 to slightly above the 3% of GDP threshold (Chart 1.6), from 3.6% in 2023. This mainly reflects a tightening of the fiscal stance in 2024 due to the phasing-out of government measures adopted in the years 2022-23 to compensate households and firms for high energy prices and inflation.[3] At the same time, higher interest spending on government debt, notably in high-debt countries, likely contributed negatively to the fiscal balance.[4]

The euro area debt-to-GDP ratio is expected to have increased slightly to close to 88% in 2024, from its already elevated level of 87.4% in 2023, and thus remain well above its pre-crisis level of 83.6% in 2019 (Chart 1.6). This increase was likely driven by the primary deficit and positive deficit-debt adjustments.

Chart 1.6

Euro area budget balance and general government debt

(percentages of GDP; fiscal stance: percentage points of potential GDP)

Sources: Eurostat, Eurosystem staff macroeconomic projections for the euro area, December 2024 and ECB calculations.

Note: In panel a) the measure of the fiscal stance is adjusted on the revenue side from 2021 by netting out grants from the NGEU Recovery and Resilience Facility as these revenues do not have macroeconomic tightening effects.

Strategic public goods help to strengthen the resilience of Europe’s economy

At the end of 2024 the fiscal stance was projected to tighten further in 2025, although at a slower pace than in previous years. However, this fiscal outlook was seen as surrounded by high uncertainty. Political risks stemmed from the fiscal plans of large euro area countries as well as from the future decisions of the new US Administration and the European responses. These risks came on top of long-term fiscal pressures arising from population ageing. Moreover, fiscal policy is increasingly expected to provide strategic public goods to strengthen the resilience of Europe’s economy by making progress on the green and digital transitions and increasing economic security and defence. For the green and digital transitions, an important contribution will be made by the NGEU programme until its expiry at the end of 2026 (see Box 1).

The reformed EU economic governance framework entered into force on 30 April 2024. The framework is focused on debt sustainability and aims to ensure sound and sustainable public finances, while incentivising structural reforms and investment.[5] A central element of the new framework is the release of countries’ medium-term fiscal-structural plans. These plans outline a path of net expenditure growth as well as the underlying macroeconomic assumptions and, for countries that aim to extend the adjustment period from four to seven years, the planned fiscal-structural measures that would allow them to put their debt ratios on a plausibly declining trajectory over the medium term.

With the release of its autumn package on 26 November and 18 December, the European Commission launched the first implementation cycle of the new economic governance framework. The package includes the assessments of the countries’ medium-term fiscal-structural plans and draft budgetary plans for 2025. The European Commission found that 15 of the 16 medium-term fiscal-structural plans submitted by euro area countries met the requirements under the new framework. The recommended fiscal adjustment period was extended from four to seven years for four euro area countries (Spain, France, Italy and Finland), on the request of the countries. The extension must be underpinned by a set of investment and reform commitments which are designed to, among other things, contribute to sustainable and inclusive growth and resilience, to support fiscal sustainability.[6]

A multi-annual net expenditure path is the main surveillance indicator under the new economic governance framework

Following a recommendation by the European Commission, the ECOFIN Council decided in July 2024 to open an excessive deficit procedure for five euro area countries, namely Belgium, France, Italy, Malta and Slovakia. To correct the excessive deficits, the Commission recommended multi-annual net expenditure paths in line with the available medium-term fiscal-structural plans. The multi-annual net expenditure path has become the main surveillance indicator under the new economic governance framework.

Implementing the revised economic governance framework fully, transparently and without delay will help governments bring down budget deficits and debt ratios on a sustained basis.

1.4 Headline inflation fell further towards the target

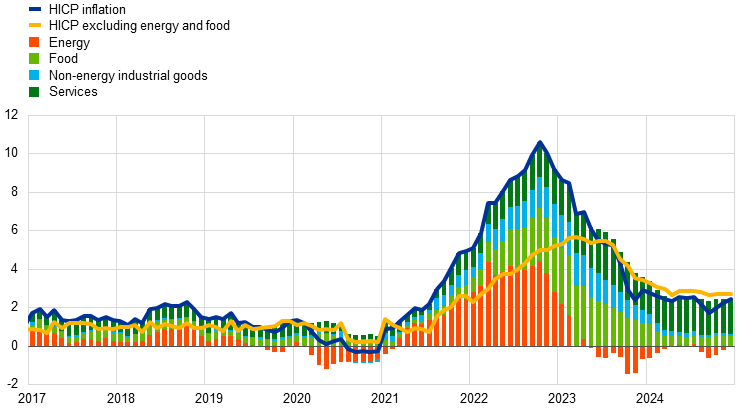

Headline inflation declined from 2.9% in December 2023 to 2.4% in December 2024, moving closer to the target

Headline inflation in the euro area as measured by the Harmonised Index of Consumer Prices (HICP) remained on a disinflationary path in 2024. It stood at 2.4% in December, 0.5 percentage points lower than a year earlier (Chart 1.7). While the disinflation process in 2023 had been driven mainly by the unwinding of earlier supply shocks, in 2024 it increasingly reflected the transmission of restrictive monetary policy. The phasing-out of public support measures that had been adopted in response to the pandemic and energy price shocks supported disinflation by dampening aggregate demand. However, it also acted as a drag on the disinflationary process, as the measures had been designed to contain inflation. In this context, most of the fluctuations in HICP inflation over the course of the year were due to energy inflation, including the uptick at the end of the year. Developments in non-energy goods prices were the main contributor to further disinflation, with both the food and the non-energy industrial goods (NEIG) components of the HICP recording lower inflation rates in December 2024 than in December 2023, by 3.5 percentage points and 2.0 percentage points respectively. In the case of NEIG, rates reached a level close to the longer-term pre-pandemic average rate of 0.6% (measured over 1999 to 2019). The declines in these two components reflected the fading-out of pipeline pressures stemming from previous cost shocks and a generally more benign international pricing environment. Conversely, the HICP services component was relatively sticky, hovering around 4.0% throughout the year. This persistence reflected the relatively strong impact of wage pressures on many services items and the influence of “late mover” items (such as insurance, housing rentals, etc.), whose prices have reacted with a delay to past exceptional inflationary shocks.

Chart 1.7

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for December 2024.

Energy inflation hovered in negative territory for most of the year, while food inflation declined significantly

Energy inflation was on average somewhat lower in 2024 than in 2023 and remained in negative territory for most of the year. The negative annual rates of energy inflation at the beginning of the year were mainly due to gas and electricity price developments, while in the period from August onwards they were driven by transport fuel prices. The volatility in wholesale energy markets related to events such as Russia’s war against Ukraine and base effects stemming from developments in the previous year added to the uneven profile of energy inflation in 2024. Food inflation strongly supported disinflation, particularly as a result of the sharp decline in the early months of the year, when the annual rates of both processed and in particular unprocessed food prices fell. This was related to the fading of pipeline pressures from the earlier energy and food commodity price surges.[7] Subsequently, food inflation saw some volatility, to a large extent reflecting the fluctuation in unprocessed food prices, particularly for vegetables, which was likely related to adverse weather conditions.

Underlying inflation indicators declined significantly in the first half of the year and moved broadly sideways in the second half

Underlying inflation indicators are aimed at capturing the persistent or common component of inflation, indicating where headline inflation is expected to settle over the medium term once temporary factors have dissipated. However, as these indicators had themselves been pushed upwards by past large supply shocks, they were expected to moderate in the overall disinflation process.[8] Core inflation – as measured by HICP inflation excluding the volatile components energy and food – declined from 3.4% in December 2023 to 2.7% in April 2024 and moved broadly sideways thereafter. It also stood at 2.7% in December 2024. The decline in core inflation in the early part of 2024 reflects the fall in NEIG inflation, while services inflation remained broadly unchanged throughout the year, hovering around a rate of 4.0%. Services inflation usually takes longer to fall than other inflation components, as many services items respond with a delay to general inflationary shocks (e.g. housing rentals, insurance, and health and education services). The persistence of services inflation in 2024 is also linked to high growth in wages, which constitute a larger share of costs in the services sector than in manufacturing. Other underlying inflation indicators also decreased during the year, albeit with some volatility, and more so during the first half of the year. Overall, these declines reflect the fading effects of the previous supply shocks as well as weaker demand amid still tight monetary policy. The latter also helps to explain clearer disinflation for goods than services, as the weight of items estimated to be sensitive to monetary policy is greater in the goods category than in the services category.[9]

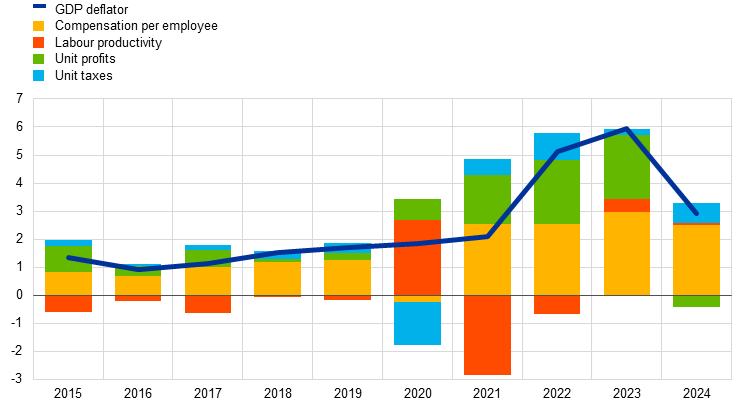

Domestic cost pressures declined as a result of moderating wage growth and buffering by profits

Domestic cost pressures, as measured by growth in the GDP deflator, decreased in 2024 to 2.9% from 5.9% in 2023. This reflected lower contributions from both unit labour costs and unit profits (Chart 1.8). The contribution from unit profits decreased as profits increasingly buffered still elevated upward pressures from unit labour costs.[10] At the same time, these pressures receded as a result of a decline in wage growth, measured in terms of compensation per employee, and some strengthening in labour productivity growth. Annual growth in compensation per employee decreased to 4.5% in 2024 from 5.3% in 2023, but remained significantly above its pre-pandemic average rate (2.2%), reflecting continued tightness in labour markets and remaining pressure for inflation compensation. The moderation in compensation per employee growth reflected a swifter response of the wage drift than the growth of negotiated wages.[11] This reflected, among other things, the likelihood that adjustments to compensate for inflation have shifted from being part of the wage drift to being incorporated in negotiated wages. At the end of 2024 euro area real wages had broadly returned to their levels before the inflation surge.

Chart 1.8

GDP deflator and components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for the fourth quarter of 2024.

Developments in labour productivity are shown inverted in the chart, as a rise (fall) in labour productivity growth lowers (increases) domestic cost pressures.

Longer-term inflation expectations remained anchored at around the ECB’s 2% target

Longer-term inflation expectations as expressed in the ECB Survey of Professional Forecasters declined from 2.1% in late 2023 to 2.0% in the survey published in the first quarter of 2024 and remained at their well-anchored level in the subsequent rounds of the year (Chart 1.9). Additional survey data, such as from the ECB Survey of Monetary Analysts and Consensus Economics, also suggested that longer-term inflation expectations were in line with the ECB’s 2% target. The restrictive monetary policy supported disinflation not only by dampening demand but also through the sustained anchoring of longer-term inflation expectations, thereby limiting the risk of second-round effects. Longer-term market-based measures of inflation compensation (such as the five-year forward inflation-linked swap (ILS) rate five years ahead) saw somewhat more volatility over the year, but converged to levels close to 2% towards year-end. Volatility observed over the year most likely owed to changes in inflation risk premia, with estimated genuine inflation expectations relatively stable at around 2%. On the consumer side, median inflation expectations for three years ahead declined from the second quarter of the year till October, when they reached 2.1%, the lowest level since February 2022 when Russia invaded Ukraine. However, expectations subsequently rose above that rate for the remainder of the year owing to higher inflation and heightened uncertainty, though they remained lower than at the beginning of the year.[12]

Chart 1.9

Survey and market-based indicators of inflation expectations

(annual percentage changes)

Sources: LSEG, ECB (Consumer Expectations Survey (CES), Survey of Professional Forecasters (SPF)) and ECB calculations.

Notes: The five-year forward inflation-linked swap rate five years ahead (5y5y ILS rate) is reported at a monthly frequency. The SPF for the fourth quarter of 2024 was conducted between 1 and 3 October 2024. In the SPF rounds for the third and fourth quarters of 2024, longer-term expectations referred to 2029; in the rounds for the first and second quarters of 2024, they referred to 2028.The latest observation for the CES is for December 2024.

1.5 Financing conditions eased gradually, while remaining tight

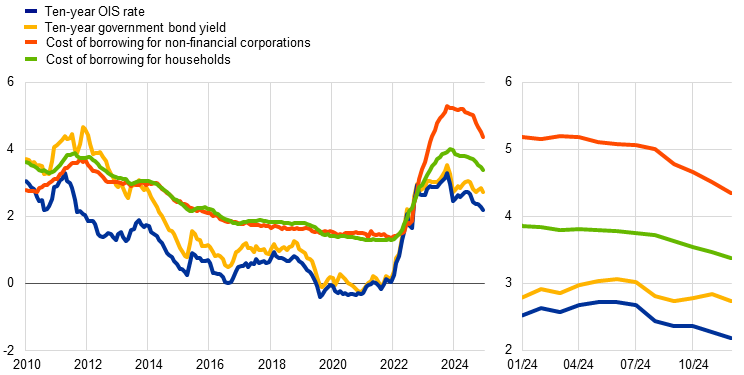

Sovereign bond yields increased, reflecting domestic and global factors

With inflationary pressures gradually abating throughout 2024 (see Section 1.4), the ECB moderated the degree of monetary policy restriction by reducing its key interest rates as from June (see Section 2.1). In the first half of 2024 the – risk-free – ten-year overnight index swap (OIS) rate gradually increased by around 50 basis points and reached a peak for the year in the summer. Thereafter, owing to the drop in financial market interest rate expectations and lower term premia, the ten-year OIS rate declined gradually – to reach an average of 2.2 % in December 2024 (Chart 1.10), which is around 20 basis points less than the average in December 2023. Long-term government bond yields generally ended 2024 at higher levels than at the start of the year. In France sovereign yields were significantly higher than a year earlier, owing to the heightened uncertainty about the country’s fiscal outlook and political developments. Spreads between long-term sovereign yields and the corresponding risk-free rates generally widened in the last quarter of the year, a development associated with the easing of collateral scarcity amid higher (expected) sovereign debt issuance and the reduction of the Eurosystem balance sheet. In Italy a compression of spreads, which benefited from a more favourable rating outlook, contributed to a decline in long-term bond yields in 2024. The euro area GDP-weighted average of ten-year nominal government bond yields remained on average in December 2024 at the same level (2.7%) as a year earlier.

Chart 1.10

Long-term interest rates and the cost of borrowing for firms and for households for house purchase

(percentages per annum)

Sources: Bloomberg, LSEG and ECB calculations.

Notes: Monthly observations. The euro area ten-year government bond yield is a GDP-weighted average. The indicators for the cost of borrowing are calculated by aggregating short-term and long-term bank lending rates using a 24-month moving average of new business volumes. The latest observations are for December 2024.

Equity markets were supported by declining risk premia and interest rates

In 2024 stock prices increased in both the non-financial sector and, to a greater extent, the financial sector. In the latter, they were led by the banking sector, which benefited from high levels of profitability. The broad indices of euro area non-financial corporation and bank equity prices ended 2024 around 3% and 21% above their respective end-2023 levels. A decline in equity risk premia, better short-term earnings expectations, higher distributed dividends and lower long-term risk-free rates supported equity prices. Corporate bond yields declined in both the investment grade and high-yield segments and stood at lower levels at the end of December 2024 than a year earlier, owing to lower risk-free rates and a compression of spreads.

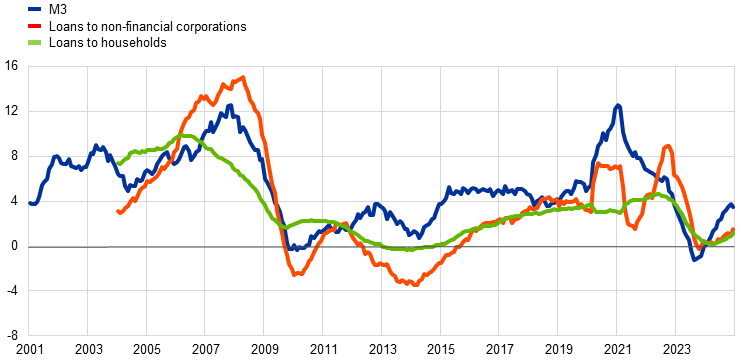

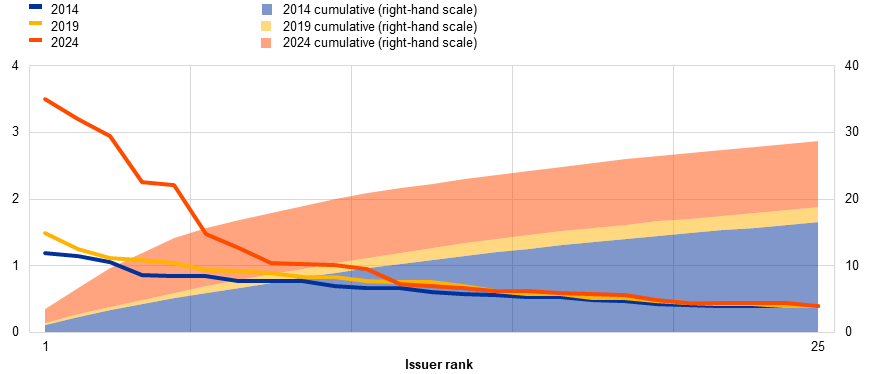

Broad money and bank intermediation reflected the moderation in the degree of monetary policy restriction

Bank deposits stopped contracting and started to recover towards the end of 2024 and broad money (M3) recovered as the degree of monetary policy restriction moderated. The annual rate of change of M3 was 3.4% in December, compared with zero in December 2023 (Chart 1.11). The recovery was driven by net foreign inflows, which reflected the sizeable current account surplus that stemmed from weak imports and foreign interest in euro area bonds amid attractive yields. Those inflows broadly offset the liquidity drain resulting from the reduction in the Eurosystem balance sheet. With funds borrowed under the third series of targeted longer-term refinancing operations being repaid (in full by the end of the year) and the Eurosystem asset portfolios contracting, banks continued to turn to more expensive market funding sources. Their funding costs nonetheless gradually declined from the peak levels of 2023, although by less than policy rates. Bank balance sheets remained robust overall.

Bank lending rates declined for firms and households, yet financing conditions remained tight

Financing conditions in the euro area remained restrictive in 2024, although the cuts in the key ECB interest rates reduced the degree of monetary policy tightness somewhat. The nominal cost of borrowing for firms and for households declined to some extent, after reaching the highest levels in almost 15 years in 2023. The composite bank lending rate for loans to non-financial corporations stood at 4.4% in December, down by about 90 basis points compared with the end of 2023, and the equivalent rate for households for house purchase declined by about 60 basis points to 3.4% (Chart 1.10). The sizeable spread between the rates for firms and households that had emerged during the monetary policy tightening phase was thus only marginally reduced. The disparity in lending rates across countries remained contained, a sign that the ECB’s monetary policy was generally being transmitted smoothly across the euro area.

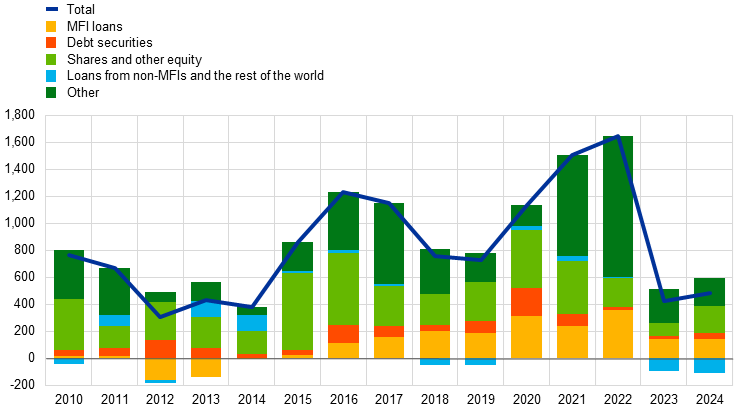

Bank lending to firms and to households remained weak but showed signs of a recovery

Bank lending to firms and to households remained weak on the back of still tight credit conditions and weak aggregate demand (Chart 1.11), while showing signs of a recovery in the second half of 2024. As indicated by the euro area bank lending survey, banks’ credit standards (i.e. internal guidelines or loan approval criteria) for firms tightened in the fourth quarter of 2024, after they had broadly stabilised over the previous quarters. The availability of bank loans improved only temporarily before deteriorating in the fourth quarter, according to the survey on the access to finance of enterprises. The annual growth rate of bank loans to firms was 1.7% in December. Overall, corporate debt financing remained weak and the net flows of external financing to firms were considerably below their longer-term dynamics, despite a pick-up in issuance and valuations of listed shares (Chart 1.12). Turning to lending to households, the gradual recovery in the annual growth rate of bank loans, to 1.1% in December, was mostly driven by mortgages. This was in line with the overall easing in credit standards during the year and a strong rebound in loan demand reported in the bank lending surveys in the second half of 2024, as well as with the sustained house purchase intentions reported in the Consumer Expectations Survey throughout the year. At the same time, by the end of the year the percentage of households reporting a deterioration in access to credit in that survey still outweighed the percentage of households reporting an improvement, with sustained recourse to consumer credit concentrated among lower income households. Moreover, banks continued to report a tightening in credit standards on consumer credit throughout 2024.

Chart 1.11

M3 growth and the growth of credit to firms and households

(annual percentage changes)

Source: ECB.

Notes: Firms are non-financial corporations. The latest observations are for December 2024.

Chart 1.12

Net flows of external financing to firms

(annual flows in EUR billions)

Sources: ECB and Eurostat.

Notes: Firms are non-financial corporations. MFI: monetary financial institution. In “loans from non-MFIs and the rest of the world”, non-monetary financial institutions consist of other financial intermediaries, pension funds and insurance corporations. “MFI loans” and “loans from non-MFIs and the rest of the world” are corrected for loan sales and securitisation. “Other” is the difference between the total and the instruments included in the chart and consists mostly of inter-company loans and trade credit. The latest observations are for the third quarter of 2024. The annual flow for 2024 is computed as a four-quarter sum of flows from the fourth quarter of 2023 to the third quarter of 2024. The quarterly euro area sector accounts are subject to major revisions every five years; the most recent one took place in 2024, which explains why the data in some years differ significantly from those used in the previous Annual Report.

Box 1

The lasting impact of the COVID-19 pandemic and structural trends on productivity growth

The euro area is undergoing a transformative period characterised by economic shocks and profound structural changes, with an impact on productivity growth over the medium and long term. In recent years it has encountered a unique blend of disruptions and ongoing structural shifts that are influencing productivity growth in complex and uncertain ways. The COVID-19 pandemic, the rapid digital transition, and the green and demographic transitions stand out as pivotal factors affecting the medium and long-term productivity outlook. Each of these elements introduces distinct mechanisms through which they affect productivity, and their interactions further complicate the economic landscape. This box examines these dynamics and their implications for productivity growth. It is based on recent work on productivity by a group of experts from the European System of Central Banks (ESCB).[13]

The lasting impact of the pandemic on productivity growth

The pandemic caused widespread disruptions across countries, sectors and firms, affecting productivity growth in distinct ways. The broad scope of the crisis, coupled with measures such as lockdowns and altered work and consumption patterns, as well as the broad policy support provided to firms and households, marked a departure from previous economic downturns.

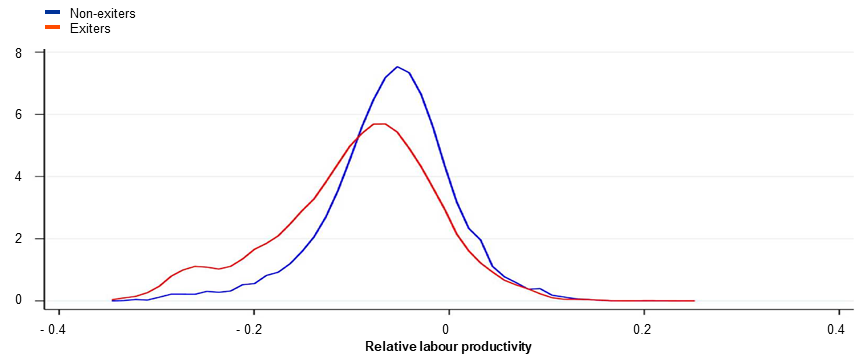

The policy responses prevented widespread bankruptcies but weakened the productivity-enhancing reallocation of resources. Available data show that the crisis resulted in low-productivity firms contracting significantly more than those whose productivity was higher, or being more likely to exit a market than their high-productivity counterparts, which helped resource reallocation in the short term (Chart A). However, this effect was less pronounced than in previous crises, as a result of comprehensive policy support that forestalled firm exits and contraction. Analysis by the ESCB Expert Group shows that the allocation of subsidies to firms became more distortionary over time, despite unchanged eligibility criteria.

The pandemic accelerated the digitalisation process, shifted consumer behaviour and had an impact on sick leave patterns and educational attainment, with possible long-term effects. The deepening of the digital economy, including increased use of remote working, supported by initiatives like the NGEU programme, offers a promising outlook. At the same time, the pandemic had long-lasting effects on the labour force, and its long-term consequences for productivity growth are not yet possible to fully quantify.

Chart A

Distribution of the productivity of firms that exited a sector compared with firms that survived in the same sector in 2020

(density)

Source: Authors’ calculations based on Orbis-iBACH firm-level data.

Notes: The dataset covers Belgium, Germany, Spain, France, Italy and Portugal. Labour productivity is defined as real value added per employee.

Digital transition and productivity growth

Digital technologies can boost worker efficiency by complementing tasks and enabling the outsourcing of non-core activities. Moreover, digitalisation increases market competitiveness, allows scale without mass, and broadens market access through e-commerce. Firm-level data from countries such as France and Austria demonstrate that investments in digital technologies can lead to sustained productivity growth, albeit after an initial adjustment period and of relatively small magnitude on average.

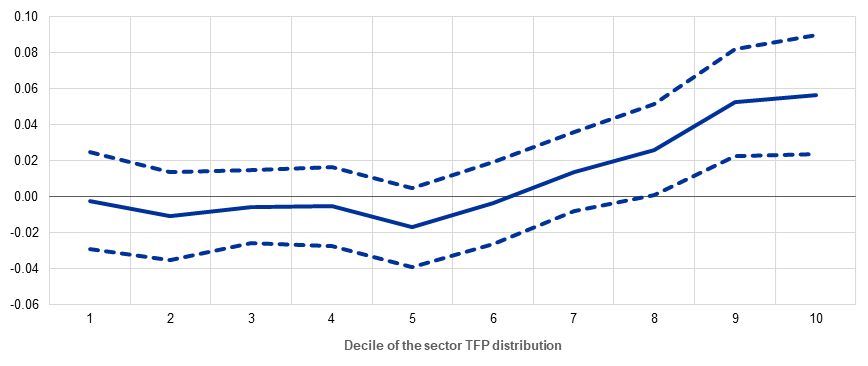

Productivity gains from digitalisation are highly heterogeneous across sectors and firms. While the average impact of digital investment is small, sectors that can benefit from digitalisation see impacts 17 times larger than the average. Moreover, only about 30% of firms, typically the most productive, manage to use new digital technologies in innovative and disruptive ways to increase their productivity, because they have in place the required skills and complementary intangibles (Chart B). As regards aggregate effects, digitalisation-related efficiency increases have significantly boosted labour productivity growth, as evidenced by simulations showing that, without these increases, productivity growth in countries such as Germany and France would have been substantially lower.

The impact of the green transition on productivity growth

The urgent need to reduce greenhouse gas (GHG) emissions has led to the implementation of policies to promote the adoption of low-carbon solutions, with a possible impact on aggregate productivity growth. Two main channels through which the green transition affects productivity are the investment in green innovation and the reallocation of resources. The need to reduce GHG emissions encourages firms to innovate and integrate more efficient, sustainable practices into their operations. Meanwhile, the economy is shifting towards greener sectors, redirecting labour and capital from polluting industries and firms. This reallocation can enhance overall productivity if resources are moved to more efficient uses.

Chart B

Estimated impact of digitalisation on TFP growth in firms with different initial TFP levels

(percentage points)

Source: Anderton, R., Botelho, V. and Reimers, P., “Digitalisation and productivity: gamechanger or sideshow?”, Working Paper Series, No 2794, ECB, March 2023.

Notes: The chart shows the sector-specific impact of digitalisation on firm TFP growth, depending on the position of the firm in the TFP distribution (1 is the lowest decile of the TFP distribution and 10 is the highest).

Empirical evidence suggests that stringent environmental policies can boost green innovation over the long run but may be detrimental to total factor productivity (TFP) growth over the short run. The analysis of the Expert Group shows that a policy mix, combining carbon taxes, regulations and support for green technologies, is needed to transition to a low-carbon economy. However, the transition will be costly in the short run as firms adjust, with a negative impact on TFP growth, in particular in small polluting firms as a result of their limited access to finance. Environmental policies are nonetheless incentivising green innovation, as shown by the significant increase in the number of green technology patents filed by polluting firms. This increase in green innovation will likely result in higher productivity growth over the long run.

The productivity impact of the reallocation of resources triggered by transition policies varies across sectors. At given sectoral productivity levels, reallocation between sectors would mechanically lower productivity given that high carbon-intensive sectors are, on average, more productive. However, within narrowly defined sectors, firm-level carbon intensity and labour productivity are not necessarily correlated. Therefore, reallocating resources from high to low carbon-intensive firms does not necessarily lead to increased productivity. Firm-level information from the EU Emissions Trading System shows that in the majority of sectors the most carbon-efficient firms are also the most productive ones. This implies that at current firm-level productivity levels, reallocation of resources towards greener firms will result in increases in labour productivity growth in those sectors, all other things being equal. However, for other sectors, such as pulp, paper and ferrous metals, the contrary is the case, and the reallocation will be productivity-decreasing.

Concluding remarks

The interplay between recent shocks and ongoing structural trends creates a complex environment for medium and long-term productivity growth. The pandemic, digital transition and green transition have each presented unique challenges and opportunities. As suggested by the recent report by Mario Draghi, policymakers must navigate these dynamics carefully to foster an environment conducive to sustained productivity growth, leveraging digital and green technologies while mitigating the possible distortive effects of policy interventions.[14] As the global economy evolves, it is imperative that policymakers in the euro area take these interactions into account to effectively shape and support future productivity growth trajectories.

In 2024 the Governing Council moderated the degree of monetary policy restriction as inflation showed signs of converging sustainably to the 2% target while the euro area economy faced sluggish growth (see Section 2.1). Interest rates remained unchanged for almost all of the first half of the year. The Governing Council then lowered the deposit facility rate by 25 basis points in both June and September, marking a shift towards a less restrictive monetary policy. It remained committed to a data-dependent, meeting-by-meeting approach to determining the appropriate level and duration of restriction. In the third quarter economic activity showed continued subdued growth with some signs of stabilisation, supported by higher consumption and global demand. The Governing Council was increasingly confident in a gradual inflation decline and further lowered the deposit facility rate by 25 basis points in October and December.

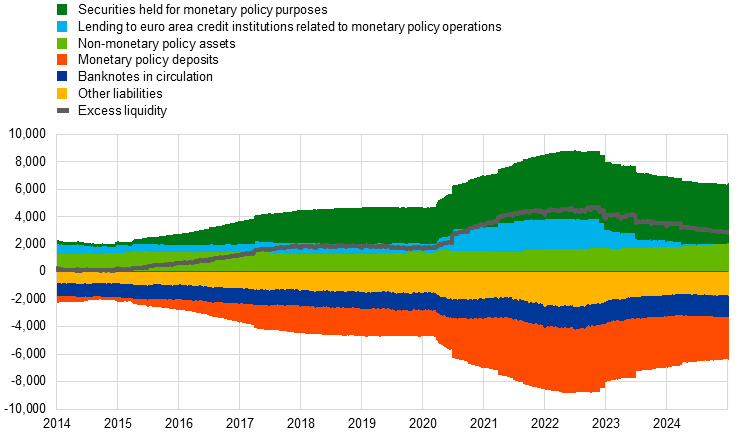

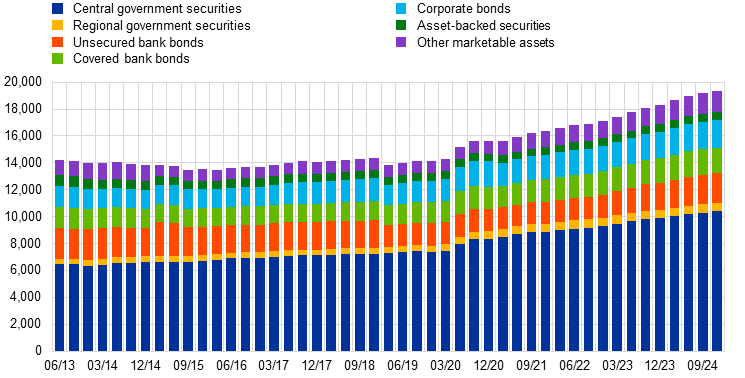

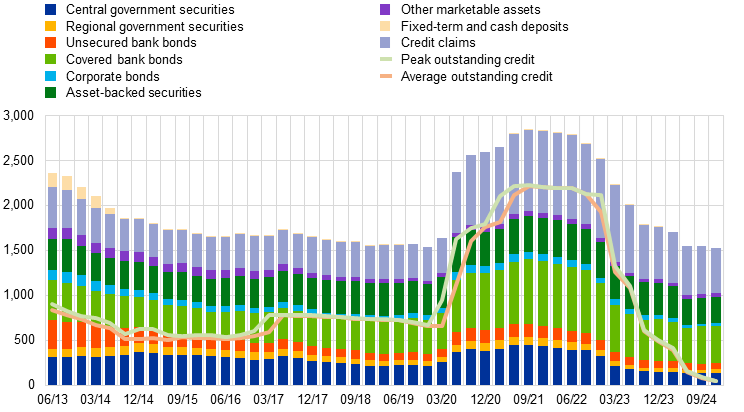

The Eurosystem balance sheet contracted by €0.5 trillion in 2024, to €6.4 trillion by year-end, as part of the normalisation that had begun in 2022 (see Section 2.2). The reduction stemmed from early repayments and the maturing of operations in the third series of targeted longer-term refinancing operations (TLTRO III), and from the decline in the asset purchase programme (APP) portfolio and to some extent also in the pandemic emergency purchase programme (PEPP) portfolio, the latter portfolio moving to partial reinvestments as of July. The Governing Council approved changes to the operational framework for implementing monetary policy in March 2024 (see Box 2) and discontinued reinvestments under the PEPP at the end of 2024.

In 2024 the Eurosystem enhanced its risk management framework to ensure risk-efficient policy implementation. As a result of high policy rates, the ECB incurred losses from negative net interest income, which will be written off against future profits (see Section 2.3 and the ECB Annual Accounts for 2024). The net interest income of the Eurosystem is expected to increase again in the years to come, supporting its financial resilience.

2.1 Moderating the degree of monetary policy restriction

The Governing Council kept rates unchanged in January to ensure a sufficiently restrictive monetary policy

In January 2024 the Governing Council assessed that the economy remained weak, following stagnation throughout 2023. The near-term outlook for economic growth in the euro area was marked by a moderation of global economic activity and trade and tight financing conditions, with risks stemming from heightened geopolitical tensions due to the conflict in the Middle East and Russia’s war against Ukraine. However, some forward-looking survey indicators pointed to a pick-up in growth further ahead. In spite of sluggish growth the labour market remained robust, following a largely steady decline in the unemployment rate that had started in September 2020. Inflation had increased in December 2023 as a result of a base effect in energy prices, and remained high at 2.9%. At the same time, most measures of underlying inflation had continued their downward trajectory as the effects of past supply shocks diminished and the impact of tight monetary policy reduced demand. The Governing Council confirmed its assessment that the key ECB interest rates were at levels that, maintained for a sufficiently long duration, would make a substantial contribution to inflation returning to its 2% medium-term target in a timely manner. It therefore decided to keep the policy rates unchanged at its January meeting, at the levels decided in September 2023, and reiterated that it would keep policy rates at sufficiently restrictive levels for as long as necessary.

The Governing Council decided to keep rates unchanged in March…

The March ECB staff macroeconomic projections entailed a downward revision of inflation, in particular for 2024, reflecting a lower contribution from energy prices. They pointed to a gradual decrease in inflation over time towards the ECB’s target. Headline inflation had declined in February, but domestic price pressures remained high, driven in part by strong wage growth and declining labour productivity. The euro area economy remained weak. Consumer spending was assessed to have been restrained, investment to have slowed and exports to have decreased, owing to slower external demand and some loss of competitiveness for euro area firms. ECB staff had revised down their near-term growth projections. The economy was still expected to recover and grow over time, supported initially by consumption and later also by investment. In particular, real incomes were expected to rebound, as a result of declining inflation and rising wages. Even though financing conditions continued to be restrictive, the dampening impact of past interest rate increases on demand was also expected to gradually fade and exports were expected to pick up. Based on its continued data-dependent approach, and its assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission, the Governing Council decided in March to keep the three key ECB interest rates unchanged.

The Governing Council also emphasised the importance of advancing the capital markets union to stabilise growth when countries face local shocks that monetary policy cannot address. A more integrated and diversified financial system would enhance private risk sharing across countries, help mitigate financial fragmentation and ensure the effective transmission of monetary policy to all parts of the euro area, among other benefits.

…and announced changes to the operational framework for implementing monetary policy

The Governing Council also approved changes to the operational framework for implementing monetary policy in March. The review of the operational framework, which had been announced in December 2022, established key principles and parameters for implementing monetary policy and providing central bank liquidity, against the background of a gradually declining amount of excess liquidity in the banking system (see Box 2). Specifically, the Governing Council decided to continue steering the monetary policy stance by adjusting the deposit facility rate and to provide liquidity flexibly, on the basis of banks’ needs, through a broad mix of instruments, including – at a later stage – structural longer-term credit operations and a structural portfolio of securities. It also approved a reduction in the spread between the rate on main refinancing operations and the deposit facility rate from 50 to 15 basis points, effective from 18 September 2024.

Inflation continued its downward path…

Inflation fell further to 2.4% in March, with most measures of underlying inflation easing, confirming the picture of gradually diminishing price pressures. However, services price inflation remained high at 4.0%, driven by domestic price increases. Wages were still growing – looking at the last quarter of 2023 – although at a slower pace than anticipated. The higher labour costs were in part being absorbed by firms’ profits, which limited their impact on consumer prices. At the same time, unit labour cost growth remained elevated as a result of weak productivity growth, but was decreasing from its previously high level.

…and the impact of restrictive monetary policy on financing conditions and the economy became more evident

As the year progressed, it became increasingly clear that the Governing Council’s restrictive monetary policy was having a significant impact on the economy and thereby on inflation. In the first quarter of 2024 high borrowing costs for businesses and households as well as tighter credit standards led to reductions in investment plans and house purchases, as well as a further decline in credit demand. While spending on services remained robust, manufacturing firms faced weak demand. Production levels continued to be subdued, especially in energy-intensive sectors. However, euro area export growth was expected to accelerate, supported by a stronger global economy and increased demand for tradable goods.

In April the Governing Council announced that it would keep the three key ECB interest rates unchanged, in restrictive territory. It emphasised its commitment to a data-dependent, meeting-by-meeting approach, with no pre-commitment to a particular rate path. The Governing Council communicated for the first time that it would be appropriate to reduce the level of monetary policy restriction if its assessment of the inflation outlook, underlying inflation dynamics and the strength of monetary policy transmission were to further increase confidence that inflation was converging to the target in a sustained manner.

The Governing Council lowered rates in June, bringing the deposit facility rate to 3.75%, after nine months of holding rates steady…

This moment arrived in June, and the Governing Council decided to lower the three key ECB interest rates by 25 basis points, after nine months of holding rates steady. Since the September 2023 meeting, when the Governing Council had last raised rates, inflation had fallen by 2.6 percentage points and the inflation outlook had improved markedly. Measures of underlying inflation had also eased, reinforcing the signs that price pressures had weakened, and inflation expectations had declined at all horizons. Monetary policy had kept financing conditions restrictive. By dampening demand and keeping inflation expectations well anchored, this had made a major contribution to bringing inflation back down.

Despite these positive developments, domestic price pressures remained strong and wage growth remained elevated, compensating for the previous surge in inflation. Inflation was seen as likely to stay above target well into the following year. Eurosystem staff had slightly revised up their inflation projections for 2024 and 2025 compared with March, anticipating fluctuations in inflation for the rest of 2024, including due to energy-related base effects. Inflation was, however, then expected to decline towards the target over the second half of 2025, owing to weaker growth in labour costs, the unfolding effects of restrictive monetary policy, and the fading impact of the energy crisis and the pandemic.

Inflation rose to 2.6% in May, although both food and goods price inflation declined. Energy price inflation experienced a modest uptick after a year of negative annual rates, and services price inflation increased to 4.1% from 3.7% in April.

Following five quarters of stagnation, the euro area economy had grown by 0.3% in the first quarter of 2024. The services sector was expanding, while manufacturing showed signs of stabilisation at low levels. Employment had increased by 0.3% in the first quarter, with around 500,000 new jobs created since December 2023. The economy was expected to remain subdued in the near term, and then recover, supported by higher wages, better terms of trade and higher real incomes. Financing costs had plateaued at restrictive levels and credit remained weak as a result of past policy rate increases. In addition, banks repaid a large amount of funds borrowed under TLTRO III in June 2024, following the large repayment in March, which led to a substantial reduction in excess liquidity.

…and confirmed the gradual reduction of PEPP holdings in the second half of 2024

The Governing Council also confirmed in June that it would reduce the Eurosystem’s holdings of securities under the PEPP by €7.5 billion per month on average over the second half of the year. This would largely mirror the approach employed for the APP.

The Governing Council decided to keep rates unchanged in July

At the time of the July Governing Council meeting, in line with expectations, most inflation measures for June were either stable or declining, although domestic price pressures and services inflation remained elevated. Wages continued to grow at an elevated rate, while their impact on inflation was still to some extent mitigated by profit margins. The incoming information broadly supported the previous assessment of the medium-term inflation outlook, and the Governing Council decided to keep policy rates unchanged at its July meeting. It reaffirmed its intention to keep monetary policy restrictive for as long as necessary.

Inflation dropped to 2.2% in August, while the economy remained subdued

Inflation dropped to 2.2% in August, from 2.6% in July. Domestic price pressures and services inflation nonetheless remained high, mainly owing to rising wages. Labour cost pressures continued to ease, but also remained elevated. The September ECB staff projections confirmed the previous inflation outlook, reinforcing the view of a gradual and sustainable return of inflation to 2%. Inflation was expected to rise over the year-end and decline towards the target over the second half of 2025. As services inflation had been higher than expected, the projections for core inflation (inflation excluding energy and food) in 2024 and 2025 were revised up slightly but continued to suggest a rapidly declining path.

Financing conditions remained restrictive and credit growth sluggish amid weak demand at the time of the Governing Council’s September meeting, while economic activity was subdued. In the second quarter of 2024 the economy had grown by 0.2%, at a slower pace than in the first quarter and below expectations. Growth had been driven mainly by net exports and government spending. Private consumption and investment, which had been expected to lead the recovery, remained weak, likely because of high geopolitical risks. As a result, ECB staff had revised down their growth projections compared with June, reflecting a weaker contribution from domestic demand over the coming quarters. The economy was expected to strengthen over time and grow by 0.8% in 2024, rising to 1.3% in 2025 and 1.5% in 2026. This recovery would be supported by higher consumption, the gradually fading effects of restrictive monetary policy and rising global demand and exports.

The Governing Council took another step in moderating the degree of monetary policy restriction in September…

In light of the new information at hand, which strengthened confidence in a gradual decline in inflation towards the ECB’s target, the Governing Council decided in September to lower the deposit facility rate – the rate through which it steers the monetary policy stance – by 25 basis points, marking a further step in moderating the degree of monetary policy restriction. As already announced on 13 March 2024, some changes to the operational framework for implementing monetary policy took effect from 18 September (see Box 2). Notably, the spread between the interest rate on the main refinancing operations and the deposit facility rate was adjusted to 15 basis points, while the spread between the rate on the marginal lending facility and the rate on the main refinancing operations remained unchanged at 25 basis points. In September excess liquidity in the euro area fell below €3 trillion, primarily owing to banks repaying loans under the TLTRO III operations. The gradual phasing-out of reinvestments of maturing bonds in the Eurosystem’s monetary policy portfolios increasingly contributed to this decline.

In September inflation declined to 1.7%, its lowest level since April 2021, reinforcing confidence that the disinflationary process was well on track. Most measures of underlying inflation either declined or were unchanged in September. Energy prices saw a significant decline, with an annual rate of -6.1%, and most measures of longer-term inflation expectations hovered at around 2%. The inflation outlook was influenced by weaker than expected economic activity. According to short-term indicators, manufacturing output was continuing to fall. Although services activity seemed to have benefited from a robust summer season, short-term indicators pointed to a decline in the third quarter of 2024. Firms were increasing investments at a slow pace, while exports weakened. Despite an increase in incomes, households had opted to consume less in favour of savings in the second quarter of 2024, the last quarter for which data were available. In response to these dynamics and their implications for inflation, the Governing Council decided to moderate the degree of monetary policy restriction further and lower the key ECB interest rates by 25 basis points in October, bringing the deposit facility rate to 3.25%.

Towards the end of the year inflation was developing in line with a sustained return to target

As the year came to a close, the flash estimate showed inflation to have increased slightly to 2.3% in November, from 2.0% in October. This increase was anticipated and was driven by an earlier fall in energy prices that dropped out of the annual rates. While food and services prices decreased, domestic inflation remained high, owing to wage pressures and the fact that some services sectors were still adjusting with a delay to the past inflation surge. Meanwhile, underlying inflation was developing overall in line with a sustained return of inflation to target. In the December projections, Eurosystem staff saw headline inflation averaging 2.4% in 2024, 2.1% in 2025, 1.9% in 2026 and 2.1% in 2027 when the expanded EU Emissions Trading System would become operational.

The euro area economy had grown by 0.4% in the third quarter of 2024, exceeding expectations, mainly driven by an increase in consumption and by firms building up inventories. At the same time, investment remained low, amid high uncertainty. Short-term indicators available for the fourth quarter of 2024 suggested that growth was losing momentum. Surveys indicated that manufacturing was still contracting and growth in services slowing. The labour market continued to show resilience. The euro area unemployment rate had been 6.3% in October 2024, unchanged from September. It had fallen almost uninterruptedly since September 2020 (8.6%), and in November it would reach its lowest level (6.2%) since the introduction of the euro. Although financing conditions remained restrictive, the recent interest rate cuts were gradually making it less expensive for firms and households to borrow. The December staff projections saw the economy strengthening over time, although at a slower pace than previously anticipated. Higher real wages were expected to strengthen household spending, while cheaper credit should stimulate consumption and investment. Provided trade tensions did not escalate, exports were seen as likely to support the recovery as global demand rose.

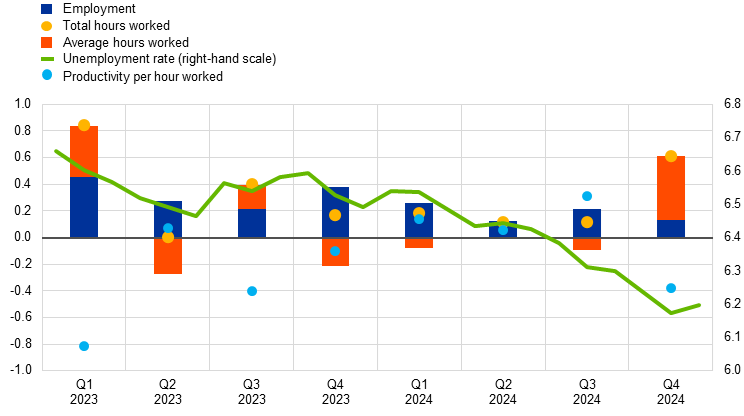

The Governing Council decided to further moderate the degree of monetary policy restriction in December

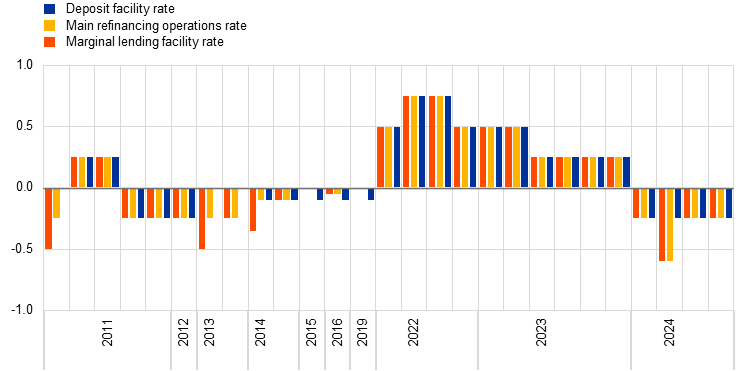

Against this background, the Governing Council decided at its December meeting to lower the key ECB interest rates by 25 basis points, and reaffirmed its commitment to ensuring that inflation would stabilise sustainably at the 2% medium-term target. The statement that policy rates would be kept sufficiently restrictive for as long as necessary was no longer included in communication. The reduction in the key ECB rates brought the deposit facility rate to 3.00% and its cumulative decrease over 2024 to 100 basis points (Chart 2.1).

Chart 2.1

Changes in the key ECB interest rates

(percentage points)

Source: ECB.

December marked the end of PEPP reinvestments and TLTRO III repayments

December also marked the end of two measures that played a key role in the low inflation era and during the pandemic: the PEPP and TLTRO III. The Governing Council ended reinvestments under the PEPP at the end of 2024. As of January 2025 the Eurosystem no longer reinvests the principal payments from maturing securities held in the PEPP portfolio. In addition, banks repaid the remaining amounts borrowed under the TLTROs on 18 December, concluding this part of the balance sheet normalisation process. Policy interest rates remain the main tool for ensuring a sustained return of inflation to target.

2.2 Normalising the Eurosystem balance sheet

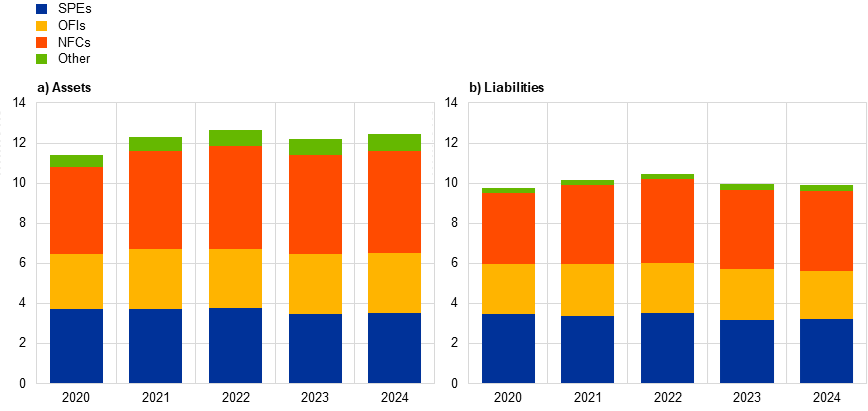

The Eurosystem balance sheet was gradually reduced as TLTRO III operations matured and holdings in the monetary policy portfolios declined

In 2024 the Eurosystem balance sheet continued the gradual normalisation that had started in 2022. By the end of the year it had decreased to €6.4 trillion (from €6.9 trillion at the end of 2023). The reduction stemmed from early repayments and the maturing of TLTRO III operations, and from the decline in the APP portfolio and to some extent also in the PEPP portfolio, the latter portfolio moving to partial reinvestments as of July.